Social

Security

How do you know when to claim Social Security?

Review of

Social Security

Analyzing the different

options available

Taxation

of Benefits

Quality of life vs

Maximized benefits

Full Retirement Age (FRA)

Year of Birth | Full Retirement Age |

|---|---|

1943-54 | 66 |

1955 | 66 and 2 months |

1956 | 66 and 4 months |

1957 | 66 and 6 months |

1958 | 66 and 8 months |

1959 | 66 and 10 months |

1960 and later | 67 |

Primary Insurance Amount (PIA)

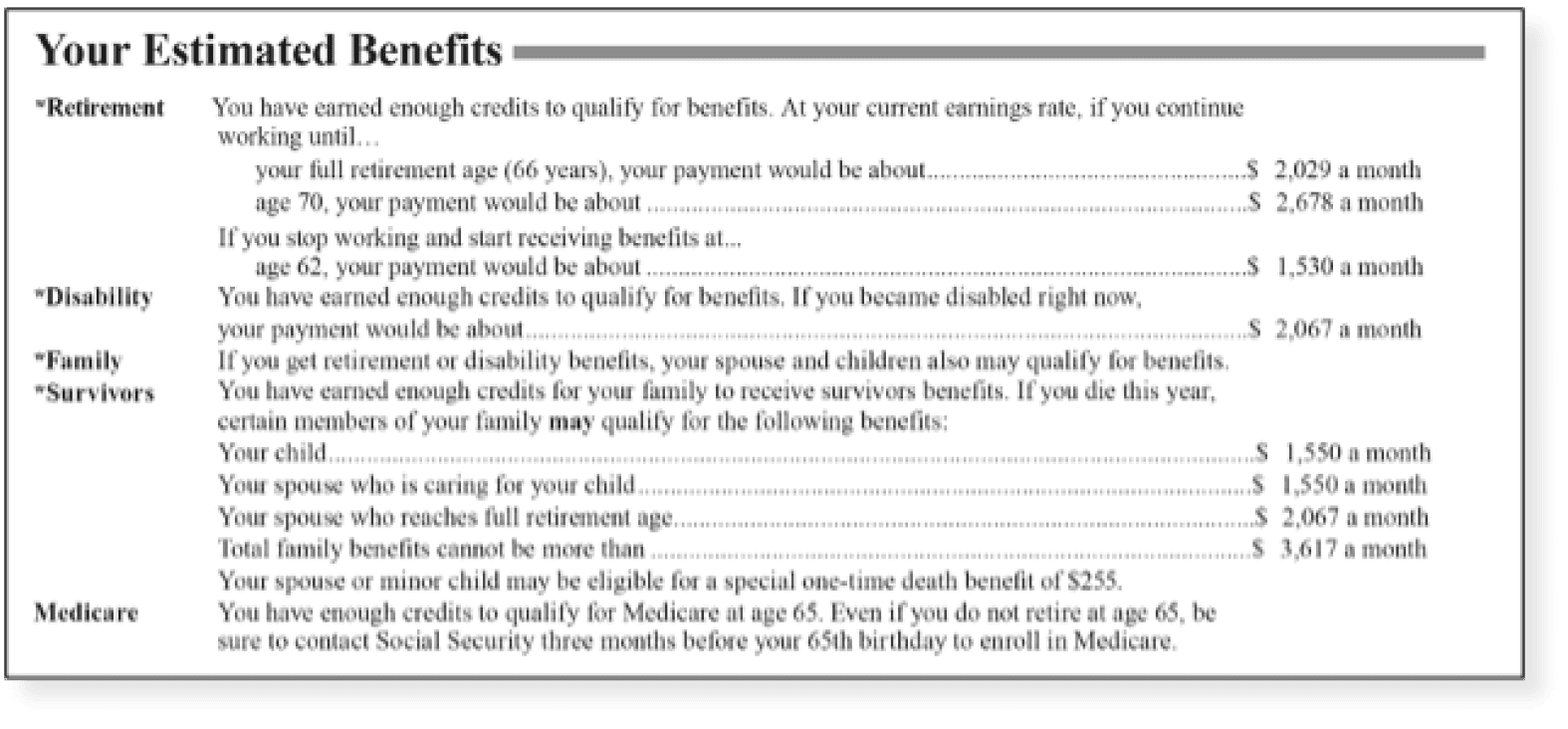

Your benefit is based on your work history. The system uses your highest 35 years of earnings to calculate your benefit. The higher those earnings are, up to the annual Social Security taxable maximum, the higher your benefit will be.

Estimate benefits

If you are over 60, the Social Security Administration sends you an annual statement, three months before your birthday, showing the amount of benefits you may be entitled to when you retire. If you are under 60 or for any other reason want to access your statement online, you can go to www.socialsecurity.gov/mystatement. The Social Security Administration stops generating statements for people who are already receiving some form of Social Security benefits.

Obtain your annual Social Security statement at

Full Retirement Age (FRA)

When to apply

Very complex and really requires a customized analysis. But here are a few points to remember.

If you apply early, your benefit starts out at some fraction of your PIA (Primary Insurance Amount) _ and remains at that percentage for the rest of your life. Your benefit amount is locked in at the time you apply, and only goes up with annual COLAs (Cost of Living Adjustments).

COLAs (Cost of Living Adjustments) magnify the impact of early or delayed retirement because the annual cost-of-living adjustment is applied to either the lower or higher amount. This causes the disparity to increase with each passing year.

The "when to apply" question impacts survivor benefits as well. In fact, if your spouse earned more than you did so that their PIA (Primary Insurance Amount) is higher than yours, it is even more important for him to delay filing. This will increase your survivor benefit. If they pass away first, their higher benefit will transfer over to you. So you want to do whatever it takes to maximize that survivor benefit. The way to do that is to have him apply for his benefit at age 70.

Reasons to not file before FRA

Getting stuck with a reduced benefit is not the only reason not to file for Social Security before full retirement age (FRA). Another reason is that if you are still working, some or all of your benefit may be withheld due to the earnings test. $1 in benefits will be withheld for every $2 you earn over $19,560 in 2022. Now, this is not a reason not to keep working. You're going to need those extra earnings both now and in retirement, if you're managing to save some of your income. But it is a reason not to apply for Social Security before your full retirement age. After you turn full retirement age (FRA), there is no earnings test. So you can receive your full Social Security benefit and earn as much as you want from working without any benefits being withheld.

Apply before FRA

If you apply for your Social Security retirement benefit before full retirement age, you will receive a percentage of your PIA (Primary Insurance Amount). The difference between $1,400 and $2,000 may not seem like very much now, but over time claiming early can make a huge difference in the amount of total benefits you receive as well as the amount of income you receive each month.

apply at age | benefit will be % of pia if fra = 67 (born in 1960 or later) | Permanent benefit if PIA = $2,000 |

|---|---|---|

62 | 70% | $1,400 |

63 | 75% | $1,500 |

64 | 80% | $1,600 |

65 | 86.7% | $1,733 |

66 | 93.33% | $1,867 |

67 | 100% | $2,000 |

Apply after FRA (Full Retirement Age)

Conversely, if you apply for Social Security after full retirement age, your benefit will go up by 8% for each year you delay. So if your full retirement age is 67 and you apply at 68, your benefit will be 108% of your PIA. At 69 it will be 116%, and at 70 it will be 124%. So if your PIA (Primary Insurance Amount) is $2,000 and you wait until age 70 to apply, your permanent benefit will be $2,480.

apply at age | benefit will be % of pia if fra = 67 (born in 1960 or later) | Permanent benefit if PIA = $2,000 |

|---|---|---|

67 | 100% | $2,000 |

68 | 108% | $2,160 |

69 | 116% | $2,320 |

70 | 124% | $2,480 |

Why delay benefits?

Bigger checks to start

age at which benefits are claimed | Permanent monthly benefit if PIA= $2,000 & FRA=67 | income at age 70 with 2% annual COLA |

|---|---|---|

62 | $1,400 | $1,640 |

63 | $1,500 | $1,757 |

64 | $1,600 | $1,875 |

65 | $1,733 | $2,031 |

66 | $1,873 | $2,187 |

67 | $2,000 | $2,343 |

68 | $2,160 | $2,531 |

69 | $2,320 | $2,718 |

70 | $2,480 | $2,906 |

Bigger checks to start

benefits at age | if claim at 62 | if claim at 67 | if claim at 70 |

|---|---|---|---|

70 | $1,640 | $2,122 | $2,906 |

75 | $1,811 | $2,343 | $3,208 |

80 | $2,000 | $2,597 | $3,542 |

85 | $2,208 | $2,856 | $3,911 |

90 | $2,437 | $3,154 | $4,318 |

95 | $2,691 | $3,482 | $4,767 |

100 | $2,971 | $3,844 | $5,263 |

Options

Spousal Benefits

Divorced Spousal Benefits

If your marriage lasted at least 10 years…if you are currently unmarried…and if your ex-spouse is at least 62, you may be entitled to a divorced-spouse benefit. If the divorce occurred more than 2 years ago, he does not need to have filed for his own benefit. He only needs to be 62.

Survivor Benefits

Survivor benefits can be claimed as early as age 60, or 50 if you are disabled. But remember that if you claim at 60, the amount will be reduced. So young widows shouldn't automatically file for their survivor benefit as soon as they turn 60. You need to analyze all of your Social Security claiming options before deciding when to file. To qualify for a survivor benefit you must have been married to the person who died. Living together doesn't count. If he died during the marriage, you only need to have been married for 9 months. If he died after you divorced, that marriage must have lasted at least 10 years. By the way, same-sex couples can now get Social Security benefits if they are or were legally married.

Taxes

Social Security is generally taxable at the federal level and may partially be taxable at the state level. But, if Social Security is your only source of income, generally it will not be taxable. To determine if your Social Security income may be taxed, we want to combine ½ of your Social Security Benefits with other income sources. This gives us the following formula: Combined Income = Adjusted Gross Income (AGI) + Nontaxable Amount + ½ Social Security income If your combined income is higher than IRS limits within the tax year, your Social Security income is taxable. However, you will never pay taxes on more than 85% of your Social Security Income.

Quality of Life vs Maximized Benefits

A consideration most overlooked is quality of life when discussing maximizing Social Security benefits. Whether that be poor health, having an early retirement, other income sources or even wanting to make sure a spouse receives higher benefits. These are all factors to consider when evaluating how you envision your retirement – for some that can mean taking Social Security earlier and for others taking it later.

Closing

Most importantly, Social Security decisions should not be made in isolation. Social Security alone is not enough income for most people. Social Security decisions should be made within the context of your overall retirement income strategy.

Age (FRA)

apply

benefits?

Full Retirement Age (FRA)

Year of Birth | Full Retirement Age |

|---|---|

1943-54 | 66 |

1955 | 66 and 2 months |

1956 | 66 and 4 months |

1957 | 66 and 6 months |

1958 | 66 and 8 months |

1959 | 66 and 10 months |

1960 and later | 67 |

Primary Insurance Amount (PIA)

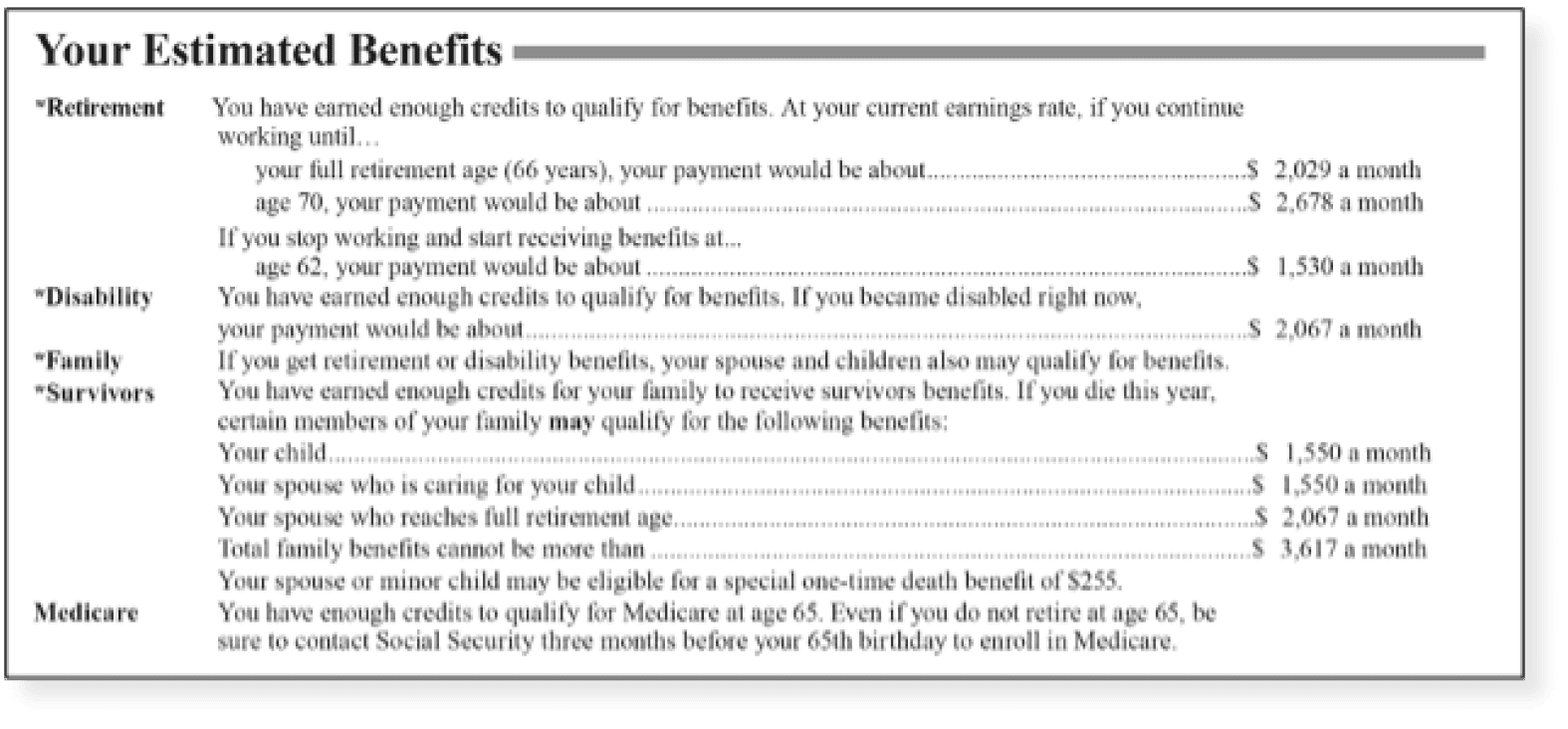

Your benefit is based on your work history. The system uses your highest 35 years of earnings to calculate your benefit. The higher those earnings are, up to the annual Social Security taxable maximum, the higher your benefit will be.

Estimate benefits

If you are over 60, the Social Security Administration sends you an annual statement, three months before your birthday, showing the amount of benefits you may be entitled to when you retire. If you are under 60 or for any other reason want to access your statement online, you can go to www.socialsecurity.gov/mystatement. The Social Security Administration stops generating statements for people who are already receiving some form of Social Security benefits.

Obtain your annual Social Security statement at

Full Retirement Age (FRA)

When to apply

Very complex and really requires a customized analysis. But here are a few points to remember.

If you apply early, your benefit starts out at some fraction of your PIA (Primary Insurance Amount) _ and remains at that percentage for the rest of your life. Your benefit amount is locked in at the time you apply, and only goes up with annual COLAs (Cost of Living Adjustments).

COLAs (Cost of Living Adjustments) magnify the impact of early or delayed retirement because the annual cost-of-living adjustment is applied to either the lower or higher amount. This causes the disparity to increase with each passing year.

The "when to apply" question impacts survivor benefits as well. In fact, if your spouse earned more than you did so that their PIA (Primary Insurance Amount) is higher than yours, it is even more important for him to delay filing. This will increase your survivor benefit. If they pass away first, their higher benefit will transfer over to you. So you want to do whatever it takes to maximize that survivor benefit. The way to do that is to have him apply for his benefit at age 70.

Reasons to not file before FRA

Getting stuck with a reduced benefit is not the only reason not to file for Social Security before full retirement age (FRA). Another reason is that if you are still working, some or all of your benefit may be withheld due to the earnings test. $1 in benefits will be withheld for every $2 you earn over $19,560 in 2022. Now, this is not a reason not to keep working. You're going to need those extra earnings both now and in retirement, if you're managing to save some of your income. But it is a reason not to apply for Social Security before your full retirement age. After you turn full retirement age (FRA), there is no earnings test. So you can receive your full Social Security benefit and earn as much as you want from working without any benefits being withheld.

Apply before FRA

If you apply for your Social Security retirement benefit before full retirement age, you will receive a percentage of your PIA (Primary Insurance Amount). The difference between $1,400 and $2,000 may not seem like very much now, but over time claiming early can make a huge difference in the amount of total benefits you receive as well as the amount of income you receive each month.

apply at age | benefit will be % of pia if fra = 67 (born in 1960 or later) | Permanent benefit if PIA = $2,000 |

|---|---|---|

62 | 70% | $1,400 |

63 | 75% | $1,500 |

64 | 80% | $1,600 |

65 | 86.7% | $1,733 |

66 | 93.33% | $1,867 |

67 | 100% | $2,000 |

Apply after FRA (Full Retirement Age)

Conversely, if you apply for Social Security after full retirement age, your benefit will go up by 8% for each year you delay. So if your full retirement age is 67 and you apply at 68, your benefit will be 108% of your PIA. At 69 it will be 116%, and at 70 it will be 124%. So if your PIA (Primary Insurance Amount) is $2,000 and you wait until age 70 to apply, your permanent benefit will be $2,480.

apply at age | benefit will be % of pia if fra = 67 (born in 1960 or later) | Permanent benefit if PIA = $2,000 |

|---|---|---|

67 | 100% | $2,000 |

68 | 108% | $2,160 |

69 | 116% | $2,320 |

70 | 124% | $2,480 |

Why delay benefits?

Bigger checks to start

age at which benefits are claimed | Permanent monthly benefit if PIA= $2,000 & FRA=67 | income at age 70 with 2% annual COLA |

|---|---|---|

62 | $1,400 | $1,640 |

63 | $1,500 | $1,757 |

64 | $1,600 | $1,875 |

65 | $1,733 | $2,031 |

66 | $1,873 | $2,187 |

67 | $2,000 | $2,343 |

68 | $2,160 | $2,531 |

69 | $2,320 | $2,718 |

70 | $2,480 | $2,906 |

Bigger checks to start

benefits at age | if claim at 62 | if claim at 67 | if claim at 70 |

|---|---|---|---|

70 | $1,640 | $2,122 | $2,906 |

75 | $1,811 | $2,343 | $3,208 |

80 | $2,000 | $2,597 | $3,542 |

85 | $2,208 | $2,856 | $3,911 |

90 | $2,437 | $3,154 | $4,318 |

95 | $2,691 | $3,482 | $4,767 |

100 | $2,971 | $3,844 | $5,263 |

Options

Spousal Benefits

Divorced Spousal Benefits

If your marriage lasted at least 10 years…if you are currently unmarried…and if your ex-spouse is at least 62, you may be entitled to a divorced-spouse benefit. If the divorce occurred more than 2 years ago, he does not need to have filed for his own benefit. He only needs to be 62.

Survivor Benefits

Survivor benefits can be claimed as early as age 60, or 50 if you are disabled. But remember that if you claim at 60, the amount will be reduced. So young widows shouldn't automatically file for their survivor benefit as soon as they turn 60. You need to analyze all of your Social Security claiming options before deciding when to file. To qualify for a survivor benefit you must have been married to the person who died. Living together doesn't count. If he died during the marriage, you only need to have been married for 9 months. If he died after you divorced, that marriage must have lasted at least 10 years. By the way, same-sex couples can now get Social Security benefits if they are or were legally married.

Taxes

Social Security is generally taxable at the federal level and may partially be taxable at the state level. But, if Social Security is your only source of income, generally it will not be taxable. To determine if your Social Security income may be taxed, we want to combine ½ of your Social Security Benefits with other income sources. This gives us the following formula: Combined Income = Adjusted Gross Income (AGI) + Nontaxable Amount + ½ Social Security income If your combined income is higher than IRS limits within the tax year, your Social Security income is taxable. However, you will never pay taxes on more than 85% of your Social Security Income.

Quality of Life vs Maximized Benefits

A consideration most overlooked is quality of life when discussing maximizing Social Security benefits. Whether that be poor health, having an early retirement, other income sources or even wanting to make sure a spouse receives higher benefits. These are all factors to consider when evaluating how you envision your retirement – for some that can mean taking Social Security earlier and for others taking it later.

Closing

Most importantly, Social Security decisions should not be made in isolation. Social Security alone is not enough income for most people. Social Security decisions should be made within the context of your overall retirement income strategy.

Ready to talk?

Our Clients Say