Retirement- Should You Take It Early or Late or Just on Time?

Imagine if Goldilocks was planning her retirement: “this date is too early” and “this date is too late” but “this date is just right”!

Sweet retirement can’t come soon enough for some of us, but it’s important to know precisely when you should retire. When planning for retirement, understand that the amount of your retirement benefits depends on your age at retirement.

Too Early!

If you begin receiving benefits before your full retirement age, you’ll receive reduced benefits. You can retire as early as age 62, but this may result in a reduction of as much as 30%.

When you choose to retire early, the benefit is reduced 5/9 of 1% for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of 1% per month.

Too Late!

Starting to receive benefits after the normal retirement age may result in larger benefits. With delayed retirement credits, you can receive your largest benefit by retiring at age 70.

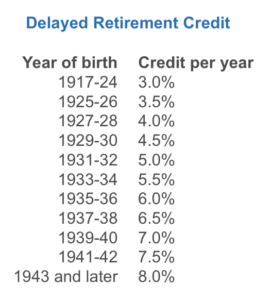

Delayed retirement credit is generally given for retirement after the normal retirement age. To receive full credit, you must be insured at your normal retirement age. No credit is given after age 69. If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start benefits. Delayed retirement credits increase a retiree’s benefits:

Note: Persons born on January 1 of any year should refer to the previous year’s credit percentage.

Just Right!

SSA.gov provides a calculator where you can learn the effect of early or delayed retirement as a percentage of your primary insurance amount. If you choose a month and year for which you’d like to begin receiving benefits, the calculator will advise you on what you can expect.

For example, if you’re too early: “You choose to receive benefits 36 months before you reach your normal retirement age. Your benefit will be 80% of your primary insurance amount.” If you’re too late: “You choose to receive benefits 24 months after you reach your normal retirement age. Your benefit will be 116% of your primary insurance amount.” And if you’re just right: “You choose to receive benefits when you reach your normal retirement age. Your benefit will be 100% of your primary insurance amount.”

Retirement planning means much more than just stashing money under the mattress until you’re ready to spend. We have strategies that will help you decide how much to save and what you need to do. Contact us today and together we can determine the right time for you to begin living your retirement dream.