Smart tax planning matters now more than ever with major changes coming soon. The lifetime gift tax exemption will drop from $13.61 million to about $5 million in 2026 without new laws. High-income earners – those making over $197,300 individually or $394,600 for married couples – need specific strategies to save on taxes.

The current tax code offers several ways to reduce your tax burden. You can maximize tax-advantaged retirement accounts and health savings accounts, which allow family contributions up to $8,300 in 2024. Tax-loss harvesting lets you deduct up to $3,000 against ordinary income. Your IRA can make qualified charitable distributions up to $105,000 directly to help manage required minimum distributions while supporting good causes.

Maximize Tax-Advantaged Retirement Contributions

Tax-advantaged retirement accounts are one of the best ways high-income earners can reduce their taxes. These accounts help you build wealth for retirement and lower your current tax burden at the same time.

401(k), IRA, and Roth IRA limits for high earners

The 2025 contribution limit for 401(k), 403(b), and most 457 plans is $23,500 if you’re under 50. People aged 50-59 can add $7,500 in catch-up contributions, which brings their total to $31,000. Those aged 60-63 can make bigger catch-up contributions of $11,250, letting them contribute up to $34,750.

High earners face some limits with traditional and Roth IRAs. The IRA contribution limit for 2025 is $7,000, plus an extra $1,000 catch-up contribution if you’re 50 or older. Income thresholds limit both deductibility and eligibility:

- Traditional IRA deductibility phases out between $123,000-$143,000 for married couples filing jointly if covered by workplace plans

- Roth IRA contributions phase out between $150,000-$165,000 for single filers and $236,000-$246,000 for married couples filing jointly

Many high-income professionals need to look at other ways to maximize their retirement savings and tax benefits.

Using SEP IRAs and Solo 401(k)s for business income

Business owners and self-employed people can access retirement accounts with much higher contribution limits. A Simplified Employee Pension (SEP) IRA lets you contribute up to 25% of compensation or $70,000 for 2025, whichever is less. You’d need about $280,000 in self-employment income to hit the maximum contribution.

Solo 401(k)s give you even more options by letting you contribute as both employer and employee. Here’s what you can contribute in 2025:

- As an employee: up to $23,500 ($31,000 if 50+, $34,750 if 60-63)

- As an employer: up to 25% of compensation

- Total maximum: $70,000 ($77,500 if 50+, $81,250 if 60-63)

Most self-employed people with moderate income can contribute more to a Solo 401(k) than a SEP IRA because of this dual contribution structure.

Backdoor and Mega Backdoor Roth strategies

High earners who make too much for Roth IRA can use the “backdoor Roth” strategy. You make a non-deductible contribution to a traditional IRA and convert it to a Roth IRA soon after.

The “mega backdoor Roth” is an even better option if your 401(k) plan allows after-tax contributions. This two-step process lets you:

- Make after-tax contributions to your 401(k) beyond the standard employee limit

- Convert these funds to either a Roth 401(k) or Roth IRA

You could potentially add another $46,500 ($46,500 = $70,000 – $23,500) to Roth accounts in 2025, assuming no employer match. Your 401(k) plan needs to allow both after-tax contributions and in-service withdrawals or in-plan Roth conversions.

At Fuchs Financial, we recommend speaking with a financial professional before doing any Roth conversions. You can schedule a complimentary introductory call with one of our fiduciary financial advisors by clicking here.

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA)

HSAs are one of the few accounts that offer triple tax advantages. If you have a high-deductible health plan in 2025, you can contribute $4,300 for self-only coverage or $8,550 for family coverage. People 55 and older can add $1,000 more.

HSAs give you three tax benefits:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

HSA funds roll over each year and you can invest them for growth, unlike Flexible Spending Accounts (FSAs). FSAs let you contribute up to $3,300 in 2025 but usually follow a use-it-or-lose-it rule, though some plans let you carry over up to $660.

529 plans and education savings benefits

529 plans don’t lower your federal taxable income right away, but they’re still great for high-income earners’ tax planning. These education savings accounts grow tax-free and withdrawals are tax-free when used for qualified education expenses.

New laws have added more qualified expenses:

- Up to $10,000 yearly for K-12 tuition

- A lifetime maximum of $10,000 for student loan repayments

- Expenses for apprenticeship programs

Make sure you understand each account’s rules and requirements before using these tax strategies for high-income households.

Use Tax-Loss Harvesting to Offset Gains

Tax-loss harvesting serves as a valuable strategy in the high-income earner’s tax planning toolkit. You can turn market downturns into tax savings. This method lets you sell underperforming investments at a loss and use those losses to offset capital gains from profitable investments, which reduces your overall tax liability.

How to identify losses to harvest

High income tax planning requires regular reviews of your taxable investment portfolio to find positions that have declined in value since purchase. You can start tax-loss harvesting by identifying investments that:

- Have dropped substantially in value (research suggests waiting until investments drop by 10-15% at the time of monthly or daily reviews)

- No longer match your investment strategy or show poor prospects for future growth

- Can be easily replaced with similar but not exact investments

To learn about potential losses, start with short-term losses (investments held less than a year). These offer the greatest benefit to offset short-term gains, which face higher ordinary income tax rates. Note that the tax code requires losses to first offset gains of the same type, but you can apply excess losses to the other type.

High-net-worth investors should use a “throttled harvesting” approach for large investment positions instead of selling everything at once. You can sell portions of the position over time to manage risk while capturing tax benefits.

Avoiding the wash sale rule

The wash sale rule plays a crucial role in tax strategies for high-income households. IRS regulations prevent you from claiming a loss if you buy the same or a “substantially similar” security within 30 days before or after selling at a loss. This rule applies to all accounts you or your spouse own, including retirement accounts like IRAs and 401(k)s.

You can avoid triggering a wash sale while you retain market exposure by:

- Buying a similar but not exact investment (like selling shares of one technology company and buying shares of another, or replacing an S&P 500 index fund with a Russell 1000 index fund)

- Waiting at least 31 days before buying back the original investment

- Buying more of the stock before selling, then waiting 31 days to sell the loss positions

Cryptocurrency investors should know that wash sale rules don’t currently apply to crypto assets since they’re not regulated as securities. This creates unique planning opportunities if you have digital asset holdings and high income.

When to use this strategy for maximum benefit

Year-round strategy implementation works better than focusing on tax-loss harvesting at year-end. The market historically shows its highest returns in November and December, which makes harvesting during these months less effective.

These approaches help maximize your results:

- Set up a systematic year-round tax-loss harvesting program with quarterly or monthly reviews

- Use market corrections to find tax-loss harvesting opportunities

- Create automatic notifications when investments hit predetermined loss thresholds

- Align with other tax reduction strategies like charitable giving or retirement contributions

Tax-loss harvesting offers three key benefits: You can offset unlimited capital gains with capital losses. You can deduct up to $3,000 ($1,500 if married filing separately) against ordinary income if losses exceed gains. Any remaining losses carry forward indefinitely to offset future gains or income.

Timing matters in tax saving strategies, especially if you expect significant future capital gains from selling a business, real estate, or other appreciated assets. Market downturns let you build a “bank” of capital losses that can offset future gains when they materialize.

Your success with tax-loss harvesting depends on generating losses, converting them into tax savings efficiently, and—most importantly—reinvesting those tax savings back into the market. The compound growth benefits make this strategy particularly valuable for high-income taxpayers, but only if you complete this final reinvestment step.

Leverage Charitable Giving for Tax Deductions

Tax-savvy charitable giving helps wealthy people support causes they care about and reduce their tax burden. Smart charitable planning lets high-income earners make the most of their donations and tax benefits. Here are three sophisticated tax reduction strategies that use charitable contributions.

Donor-Advised Funds (DAFs) for multi-year giving

DAFs work like dedicated charitable investment accounts that give you flexibility and tax advantages. You’ll get an immediate tax deduction for the full fair market value when you contribute. You can still recommend grants to qualified charities over time.

DAFs offer these main benefits:

- You get a tax deduction right away, even if you distribute to charities later

- Assets grow tax-free inside the DAF

- You can donate cash, securities, real estate, and private business interests

- Record-keeping becomes easier with one tax receipt no matter how many charities receive grants

DAFs shine as multi-year giving tools through “bunching” – putting several years of planned donations into one tax year. To name just one example, a couple might put $20,000 in a DAF instead of giving $10,000 yearly for two years. This could boost their total tax deductions by $3,800 across those years. The strategy works best when itemized deductions might fall below the standard deduction.

Qualified Charitable Distributions (QCDs) from IRAs

QCDs are a chance to save on taxes if you’re 70½ or older. The rules let you transfer up to $108,000 yearly from IRAs straight to qualified charities without counting it as taxable income. This amount is up from $105,000 in 2024.

QCD strategy brings several advantages. The distributions count toward required minimum distributions (RMDs) if you’re 73 or older. Money goes straight to charity without touching your hands, so it doesn’t raise your adjusted gross income (AGI). This helps avoid higher Medicare premiums and keeps more Social Security benefits tax-free. It also prevents losing other tax deductions.

Each spouse can make QCDs up to the limit from their IRAs. This means couples could direct $216,000 yearly to charity with major tax benefits. The IRA custodian must send the money straight to qualifying charities by December 31 for that tax year.

Donating appreciated stock to avoid capital gains

Donating appreciated securities held over a year stands out among tax strategies. You can deduct the full fair market value from taxable income (up to 30% of AGI). Better yet, you’ll skip capital gains taxes that would apply if you sold the securities first.

Here’s what this means: A $50,000 stock donation with a $10,000 cost basis creates $27,020 in tax benefits. Cash donations of the same amount only save $17,500. Charities receive about 20% more value than if you sold the securities and donated after-tax proceeds.

This method helps balance portfolios without tax hits. You can buy back the same securities at current prices after donating appreciated positions. This resets your cost basis higher. Business owners looking to sell can save big by gifting business interests before the sale. This avoids the 20% capital gains tax on those proceeds.

The best results come from mixing charitable giving with other tax reduction methods. A tax professional can help line up these approaches with your financial goals and keep everything within tax rules.

Structure Income Through Trusts and Estate Planning

Rich people can cut their taxes by a lot through smart trust and estate planning. These advanced methods help you save on taxes right now and build wealth that lasts for generations.

Using Grantor Retained Annuity Trusts (GRATs)

GRATs are powerful tools that help wealthy people transfer growing assets to their heirs with minimal tax impact. The grantor moves assets into an irrevocable trust but gets fixed yearly payments for a set time.

The biggest advantage lies in tax calculation methods. You can subtract the grantor’s kept interest from the asset’s fair market value. A “zeroed-out GRAT” matches annuity payments to the original contribution plus IRS Section 7520 rate interest, which means little to no gift tax.

GRATs work best with assets that grow faster, because any growth above the IRS hurdle rate goes to beneficiaries tax-free when the trust ends. You’ll get the best results if you:

- Use increasing annuity payments (up to 20% yearly) to keep more assets in trust early on

- Set up shorter-term “rolling GRATs” to lower mortality risk

- Pick assets that could grow a lot, like pre-IPO stocks or family business stakes

Qualified Small Business Stock (QSBS) stacking

QSBS stacking helps high-income earners cut taxes on small business investments. Section 1202 of the Internal Revenue Code lets investors skip paying taxes on all capital gains from qualified small business stock bought after September 27, 2010, if they hold it for five years.

Each taxpayer can exclude $10 million or 10 times the stock’s adjusted basis per year, whichever is higher. All the same, smart “stacking” lets investors multiply this benefit across different taxpayers.

The best stacking methods include:

- Giving shares to non-grantor trusts for extra $10 million exclusions

- Setting up Incomplete Non-Grantor Trusts in Nevada or New Hampshire

- Creating irrevocable trusts for family members with possible valuation discounts

The stock must come from a U.S. C corporation with less than $50 million in gross assets when issued. The company needs to use at least 80% of its assets in qualified business activities.

Gifting strategies to reduce estate size

Smart gifting helps wealthy people cut their estate taxes. The current lifetime gift and estate tax exemption is $13.99 million per person. This amount will drop by a lot in 2026 unless new laws pass.

Many rich taxpayers are moving wealth faster through various gifting options:

- Annual gifts to multiple people without touching lifetime exemption

- Paying education or medical bills directly to providers, which avoids gift tax

- Setting up irrevocable trusts to remove assets from taxable estates while keeping some control

Lifetime gifts often save more taxes than estate transfers. Estate taxes hit the entire value including tax payment amounts. Gift taxes skip the amount used for taxes, which saves beneficiaries about 11%.

Business owners looking at big payouts can mix gifting with QSBS or GRAT strategies to save taxes across generations. You should always work with estate planning experts to set up these advanced tax-cutting strategies properly.

Time Income and Bonuses Based on Tax Brackets

Tax reduction opportunities exist beyond traditional deductions and credits when wealthy individuals time their income recognition strategically. High-net-worth taxpayers can minimize their lifetime tax rates by controlling when they receive their income.

Deferring income to lower-tax years

Tax bracket management is the foundation of sophisticated high income tax planning. You can move income between tax years to optimize your tax situation. To cite an instance, someone in the 32% bracket who expects to return to the 35% bracket next year could “fill up” their current lower bracket by realizing extra income now. This strategy works best when:

- Your self-employment income changes a lot between years

- One-time income events push you into higher brackets

- You’re getting close to retirement with lower future income

- Tax laws might change soon

Executives who receive substantial year-end bonuses can ask to delay payment until January. This pushes their tax liability into the next calendar year. They can also convert their retirement accounts to Roth IRAs during lower-income years to transform tax-deferred savings into tax-free retirement income.

Using Nonqualified Deferred Compensation (NQDC) plans

NQDC plans serve as powerful tax planning tools for executives and high earners. These plans don’t have contribution limits like qualified retirement plans. Participants can postpone large portions of their salary, bonuses, or commissions until retirement.

NQDC plans come in four types:

- Salary Reduction Arrangements let you defer regular income

- Bonus Deferral Plans focus on annual bonus postponement

- Top-Hat Plans (SERPs) benefit the core team

- Excess Benefit Plans work around qualified plan limitations

The main benefit comes from receiving income during years with lower tax brackets. Executives can defer large bonuses into retirement and reduce their tax burden through smaller distributions during lower-income years.

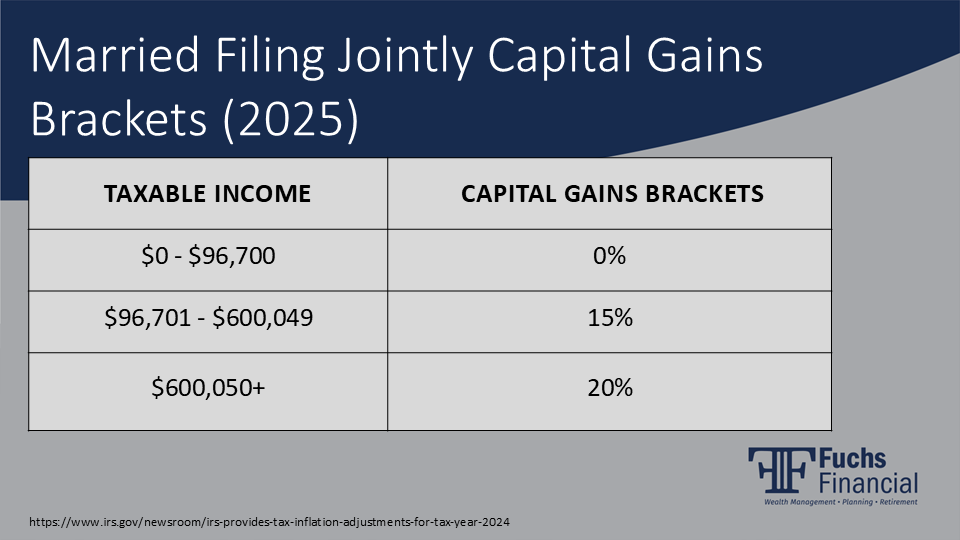

Capital gains timing and bracket management

Smart timing of capital gains realization helps preserve wealth. Long-term capital gains get better rates (0%, 15%, or 20% based on income) compared to short-term gains taxed as regular income.

Note that high-income investors should spread substantial gains across multiple years to avoid these key thresholds:

- A 3.8% Net Investment Income Tax kicks in above $200,000 for singles/$250,000 for married couples

- The 20% capital gains rate starts at about $500,000 income ($492,300 for singles, $553,850 for married filing jointly)

Investors can save money by timing transactions during lower-income years or using strategic tax-loss harvesting to offset gains.

Plan Around Equity Compensation and Alternative Assets

Equity compensation makes up much of the wealth for high earners. These assets bring complex tax challenges that need expert planning. Smart management of these assets can lower tax liability and help build long-term wealth.

Managing ISOs, RSUs, and AMT exposure

ISOs give tax advantages when handled right. The gains from ISOs qualify for better long-term capital gains treatment if you hold shares for a year after exercise and two years from the grant date. But there’s a catch – exercising ISOs without selling them that year might trigger Alternative Minimum Tax (AMT). The “spread” between exercise price and fair market value becomes an AMT adjustment item.

RSUs work differently. Tax kicks in when they vest, and their full market value counts as ordinary income. Companies usually hold back shares for estimated taxes. High earners should note that this withholding rate might not cover their tax bracket fully.

High-income earners could benefit from strategic “disqualifying dispositions” of ISOs in specific cases. This strategy triggers ordinary income tax instead of AMT, which works well when:

- Stock prices drop substantially after exercise

- You need to rebalance your portfolio to cut concentration risk

- You want cash for big purchases like homes

Crypto and NFT tax considerations

Digital assets create unique challenges and opportunities in tax planning for high incomes. The IRS sees cryptocurrencies and NFTs as property. You pay capital gains tax when you sell or exchange them. Here’s what you should know:

- NFTs tied to physical collectibles might face 28% long-term capital gains rates instead of the usual 20% cap

- Crypto assets stay exempt from wash sale rules right now, which opens up special tax-loss harvesting options

- You can add gas fees from NFT deals to your cost basis, which might lower your taxable gains

- You can claim tax deductions on worthless cryptocurrency losses with proper documentation

Carried interest and holding period strategies

Carried interest gives investment managers powerful tax reduction tools. Fund managers usually get 20% of profits as carried interest. This qualifies for better long-term capital gains rates at 23.8% maximum versus ordinary income rates that go up to 40.8%.

The Tax Cuts and Jobs Act pushed the holding period to three years. Most private equity funds hold assets beyond five years, so this change barely affects tax planning.

The “vertical slice” approach helps with wealth transfer planning. Fund managers can give parts of both capital commitment and carried interest to family members or trusts before values rise. This method uses carried interest’s low initial value compared to future potential and creates big estate tax savings.

Conclusion

Tax planning gets way more complex as income and wealth grow. All the same, high-income earners can legally cut their tax burden while building long-term wealth by using the strategies we covered. Smart tax management through retirement accounts, investment strategies, charitable giving, and trust structures opens up big opportunities to save on taxes.

These strategies work best together rather than alone. To name just one example, you can multiply your tax savings by mixing charitable giving with appreciated stock donations while managing your retirement contributions. On top of that, smart timing of income recognition across tax years pairs well with trust strategies that help transfer wealth between generations with minimal tax effects.

High-net-worth tax planning needs regular updates and changes. Tax laws keep changing – just look at the lifetime gift tax exemption’s scheduled drop in 2026. Wealthy people must watch out for tax code changes that could shake up their financial strategies.

The tax-saving opportunities we discussed work differently for each person. Your income sources, investment mix, charitable goals, and family situation determine which strategies work best. So working with seasoned tax experts and trusted financial advisors becomes crucial to make these approaches work.

Tax strategies should balance quick wins with lasting wealth protection. Quick tax savings matter, but the main goal focuses on building financial security that lasts generations. Your tax decisions should fit into detailed financial plans that match your values and goals.

High-income earners should talk to qualified tax experts who know advanced tax planning inside out before trying these strategies. Good execution makes all the difference between smart tax management and costly mistakes that catch the IRS’s eye.

FAQs

High-income earners can employ several strategies to lower their taxes, including maximizing contributions to tax-advantaged retirement accounts, utilizing health savings accounts, implementing tax-loss harvesting, leveraging charitable giving through donor-advised funds or qualified charitable distributions, and timing income recognition to manage tax brackets effectively.

Charitable giving offers significant tax benefits for high-income earners. Strategies include using donor-advised funds for multi-year giving, making qualified charitable distributions from IRAs for those over 70½, and donating appreciated stocks to avoid capital gains taxes while still receiving a deduction for the full market value of the donation.

Wealthy individuals can use advanced trust strategies like Grantor Retained Annuity Trusts (GRATs) to transfer appreciating assets with minimal gift tax, implement Qualified Small Business Stock (QSBS) stacking to multiply capital gains exclusions, and utilize various gifting strategies to reduce estate size and potential estate tax liability.

Managing equity compensation requires careful planning. Strategies include timing the exercise of Incentive Stock Options (ISOs) to minimize Alternative Minimum Tax exposure, considering the tax implications of Restricted Stock Units (RSUs) upon vesting, and potentially using “disqualifying dispositions” of ISOs in certain scenarios to optimize overall tax outcomes.

For alternative assets, high-income earners should be aware that cryptocurrencies and NFTs are treated as property for tax purposes, subject to capital gains tax upon sale or exchange. Unlike securities, crypto assets are currently exempt from wash sale rules, creating unique tax-loss harvesting opportunities. Additionally, NFTs representing physical collectibles may face higher long-term capital gains rates.